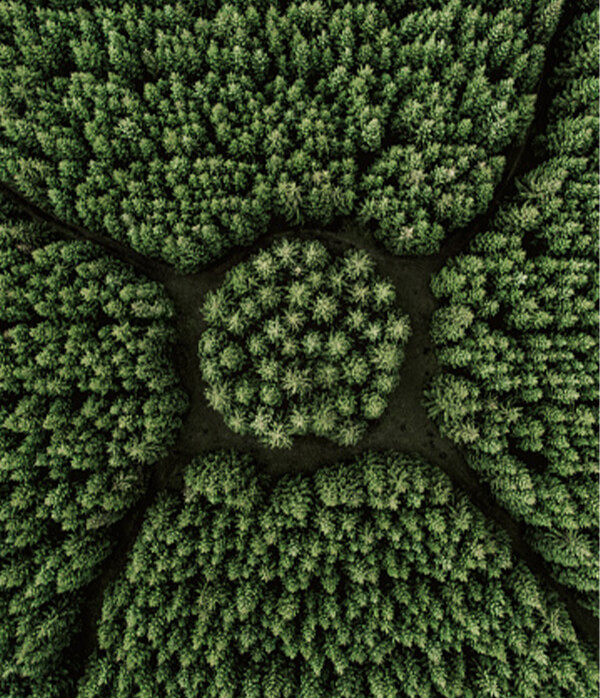

Sustainable investing

Our sustainable investing strategies empower you to create portfolios that align with your personal values while pursuing competitive risk-adjusted returns.

Our sustainable investing strategies empower you to create portfolios that align with your personal values while pursuing competitive risk-adjusted returns.

By nature, clients of the Private Bank are progress makers who strive to improve the world we live in.

Among their priorities are protecting the environment, contributing to a more equitable society and raising standards of corporate behavior.

As consumers, many of the individuals and families we serve are considering the impacts of climate change, natural resource depletion, biodiversity loss, supply chain management and human rights across the businesses with which they interact. In their business and philanthropic activities, they are committing capital to innovations that address the world’s greatest challenges.

In common with the Private Bank and the wider Citi, many of our clients believe that private capital can and should be used to effect positive change via investment strategies that incorporate sustainability principles.

Our clients are thus using their influence as investors to seek greater transparency into companies’ processes and impact, along with enhanced board oversight and ownership of risks.

They are also increasingly aware of other benefits of sustainable investing, such as holistic risk management, a diverse source of opportunities, and potential returns. Investing with Purpose (IwP) is Citi Private Bank’s approach to sustainable investing.

Our IwP offering spans managed opportunities, alternative investments and capital markets strategies that enable you to pursue your financial and sustainability objectives. Whether you seek exposure to individual investments or wish to build entire core and opportunistic portfolios that reflect your worldview and values, we can help you realize your sustainable investing goals.

We enable investors to pursue simultaneous societal change and competitive financial returns.

We begin with an in-depth understanding of your sustainability goals and preferences and implement them with investments that meet your risk and return characteristics.

Our robust platform comprises opportunities across all asset classes. The Private Bank also offers self-directed sustainable investments in order to meet risk profile requirements and thematic preferences such as renewable energy or clean water.

Moreover, we provide access to investments such as green and social bonds that have a clearly defined use of proceeds.

If you seek thematic investments, we can create this exposure by adding an opportunistic/thematic tilt to either a traditional core portfolio or a core portfolio comprising broad environmental, social and governance (ESG) managers.

Our Global Investment Lab has developed proprietary tools to give you insights into the sustainability characteristics of individual securities and managed strategies. These include ESG risks, exposure to desirable or controversial themes and corporate carbon footprint.

We can provide these insights in respect of all your holdings at Citi and elsewhere.*

Sustainable investing is when investors seek varied financial and sustainability outcomes depending on their investment objectives and processes. It encompasses four main approaches, including Socially Responsible Investing (includes Ethical investing), ESG Integration, Thematic investing, and Impact investing.

Learn more about sustainable investingThere's a widespread perception that applying environmental, social, and governance criteria means sacrificing performance. We disagree.

Sustainable investments are exposed to the same risks as other traditional investments. However, greater regulatory oversight and transparency is critical for investors to feel confident about sustainable investing. This includes understanding the ESG score behind an investment as it may not tell the full story; a deep fundamental analysis of a company or a portfolio manager’s investment processes is therefore essential.

Learn more about the risks of sustainable investmentsIn some jurisdictions, the term sustainable investment is used to describe very specific investments. For example, in the EU, the term sustainable investment has come to mean compliance with the Sustainable Finance Disclosure Regulation and or alignment with the EU taxonomy which entails investing in companies which conduct specific economic activities that meet regulation defined environmental criteria.

The four main approaches to sustainable investing are Socially Responsible Investing (encompasses Ethical investing), ESG Integration, Thematic Investing and Impact Investing. The last approach, Impact Investing, seeks to generate measurable impact in a particular environmental or social area.

Learn moreInvesting with purpose is the natural evolution of our years customizing portfolios for clients. Sustainable investing is where investors seek varied financial and sustainability outcomes depending on their investment objectives. It encompasses four main approaches, including socially responsible investing (including ethical investing), ESG integration, thematic investing, and impact investing.

Listen to colleagues from across the organization share their observations on Citi’s ESG efforts, recognizing that what we’ve achieved is significant, and is just one step in our relentless pursuit to be the best for our clients by providing sustainable investment solutions.

To help put you in touch with the right Private Bank team, please answer the following questions.