Aging populations and the expanding global middle class are likely to boost demand for healthcare over many years.

Seeking to boost portfolio immunity with healthcare

The world’s population is undergoing profound change

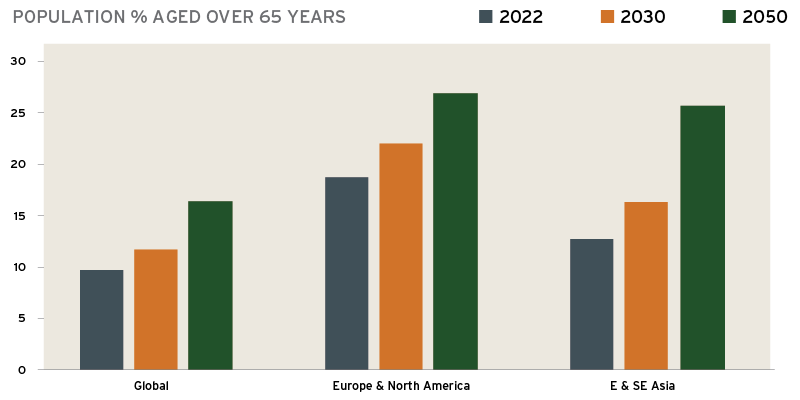

Not only are there more people on Earth than at any time previously, but their average age is now older than ever before. This pattern is set to intensify. By 2050, more than a quarter of citizens in certain global regions may be over 65 – Figure 1. This change is the result of life expectancy and fertility patterns established over many generations, which would take at least as long to reverse. At Citi Global Wealth Investments, we thus regard aging populations as an unstoppable trend.At the same time, the world’s middle class is on the rise. This phenomenon is largely driven by Asia, where economic development and rising incomes are enabling hundreds of millions of people to live and consume in ways they never have before. In mid-2017, the emerging world’s middle class was around 3.3 billion people – a number that may hit 5 billion by 2027.1

These two major shifts have far-reaching implications for societies, industries and investors everywhere.

Among the consequences we expect is growing demand for healthcare. As people get older, the amount of spending required on their healthcare increases. And with rising incomes and wealth comes the tendency to spend more on staying well and getting better from illnesses.

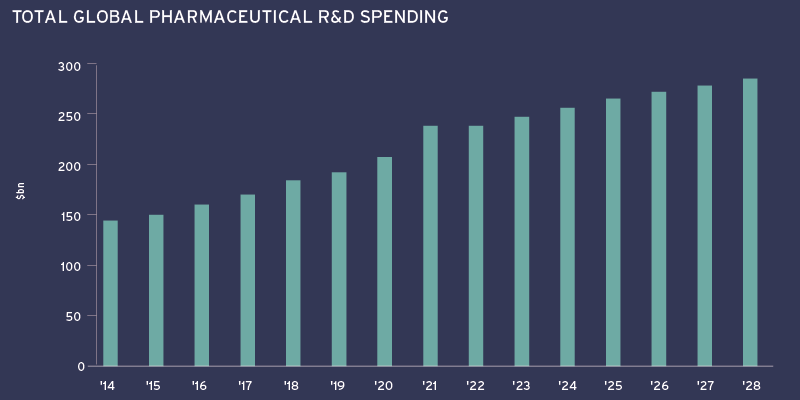

We see healthcare as well placed to meet the challenge. The sector has a strong record of innovation, driven by increasing spending on research and development, a trend that seems likely to continue – Figure 2. While we see growth potential for healthcare broadly, there are certain areas of particular focus for us.

Biologics and bioproduction

With advancing years comes greater incidence of many illnesses. These include various forms of cancer, Alzheimer’s disease, rheumatoid arthritis, osteoporosis and diabetes. Some of the most novel treatments for these conditions are biologics.

Biologics are complex drugs made from parts of or complete living cells from humans, animals or microorganisms. This “bioproduction” process differs from traditional “small molecule” drug development, where drugs are synthesized via chemical processes without living cells. Biologics have proven superior to many small molecule drugs in addressing many difficult-to-treat illnesses. And they may hold the key to treating or curing diseases that are today untreatable.

Developing biologics is now a major focus for biopharmaceutical companies. Around 60% of all drugs in development in 2022 may be biologics, up from 20% two decades ago, according to Danaher Corporation. While just 500 such products have been approved by US regulators to date, there are some 20,000 in the pipeline.2

From an investment perspective, we find the potential growth compelling. Evaluate Pharma, an industry intelligence provider, forecasts that new biological drugs – excluding COVID-related therapies – will represent $541 billion in sales by 2026, an annualized growth rate of 10% from current levels. Risks faced include clinical development failures, delays and stiff regulatory hurdles.

Life science tools

Developing cutting-edge treatments such as biologics is intensely demanding. So much so that biopharmaceutical companies often outsource parts of the long and intricate process. They do so to take advantage of specialist skills at certain stages and to seek manufacturing efficiencies. This trend is on the rise.

Some 86.9% of qualified bioprocessing respondents in the 19th annual industry survey conducted by BioPlan Associates, a biotechnology market and information provider, indicated they planned to outsource at least “some” bioprocessing activities over the next 24 months. This is up from 82.6% the year before.3

Around a third of the most frequently outsourced steps are entrusted to life science tools (LST) companies. LST companies create and deploy instruments and tests that empower the research and development process. The LST business model can be compared to that of suppliers of picks and shovels to miners during 19th century extractive booms. Irrespective of whether the miners struck gold, the hardware suppliers made money from selling them hardware.

The global LST market was estimated at around $92.2 billion in 2020. This may increase at a compound annual growth rate (CAGR) of 11.9% between 2021 to 2028, according to Grand View Research.4 Some of the key drivers could be from creating or adopting new solutions for analyzing and separating chemicals as well as genetic and other sequencing.

Risks to this growth potential include slowing demand from biopharma companies, softer academic demand due to reduced government funding, and an inability to execute on mergers & acquisitions integration.

Value-based care

The way that patients receive healthcare is changing. Traditionally, physicians and other healthcare providers have been paid according to how many services they provide to patients. This creates an obvious incentive for as many treatments to be supplied as possible. An increasingly popular alternative to this “fee-for-service” approach is “value-based care,” where providers get paid according to patient outcomes. The emphasis here is on results, including disease prevention and promoting wellness.

Over time, we believe that companies that seek to enhance patient experience and improve health outcomes are likelier to gain market share. This may be especially true in the US, the world’s largest market. US healthcare spending per head is greater than in any other country while patient satisfaction with their experience can sometimes be found wanting.

Technology could play a leading role in driving advances in value-based care. Capturing and analyzing vast amounts of patient data could make preventative measures and treatments increasingly personalized. Given their expertise in artificial intelligence, big technology companies may enter the healthcare industry and act as disruptors.

Risks to the leading incumbent providers of value-based care include competition from new entrants outside the healthcare space and potential government regulation, which could restrict flexibility and innovation.

Agetech

Caring for rapidly growing elderly populations – both in sickness and health – is an enormous challenge. Already, certain countries are feeling the pressure of shrinking workforces combined with large numbers of people requiring monitoring, companionship and help with daily functions. We believe that agetech – hardware and software that address old age challenges – may ultimately have an important role to play in addressing this situation.

Wearable devices – such as smartwatches – are already widely used to help people track their wellness. Increasingly, they may be used to monitor the health and well-being of seniors, giving early warnings of heart attacks and strokes and alerting emergency services. And by monitoring for falls, they could also help support those living independently. Likewise, robots may be able to provide vital companionship and stimulation, both for those living in their own homes and in retirement homes.

Agetech is closely related to several aspects of our unstoppable trend of digitization, including robotics, automation and artificial intelligence. Given the amount of data captured and stored – and the often personal nature of it – cyber security presents one risk to many related companies.

Investing in healthcare

We believe that demand for healthcare will likely grow faster than the economy over time. And we see a compelling case for portfolio exposure to this source of long-term growth. Healthcare is the least cyclical of all economic sectors: the least tied to economic performance. Major pharmaceuticals firms have routinely raised their dividends through turbulent times.

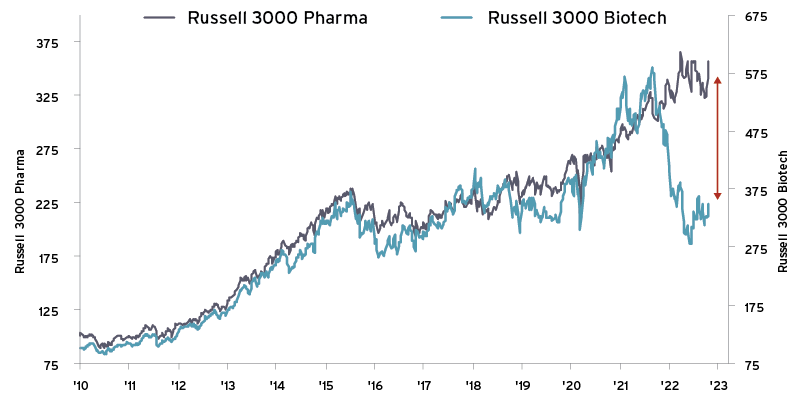

Amid 2022’s difficult conditions, for example, large-cap pharmaceuticals showed comparative resilience, falling by less than broad market indices. They may continue to perform this role in 2023, should volatility persist. By contrast, life sciences and small-cap indices underperformed – Figure 3 – but may potentially perform strongly once the Fed ceases raising and then starts cutting interest rates. Further selloffs in the meantime may present us with opportunities to build longer term positions in innovative segments such as life sciences, medical technology and biotech.

We see many possibilities for gaining exposure to this vital industry for the years ahead, including strategies from specialist managers and capital markets strategies for suitable investors. With the unstoppable trends of aging and the rise of Asia’s middle class continuing, the prognosis for healthcare looks positive. Is your portfolio taking the prescription?

Wealth Outlook

Explore other articles from Wealth Outlook 2023:

To help put you in touch with the right Private Bank team, please answer the following questions.